VSM calls for a fundamental reorganisation of the framework conditions and a European Maritime Growth Agenda

As in the previous year, the press conference of the German Shipbuilding and Ocean Industries Association (VSM) took place digitally on 4 May. The guests were welcomed by Harald FassmerVSM President and Managing Director of Fr. Fassmer GmbH & Co. KG. He emphasised that in addition to all the positive news, which can also be read in the current annual report, the pandemic has hit the industry hard. He cited the Flensburg shipyard, Nobiskrug and the Meyer Werft plan as examples. He pointed to the 20,000 direct jobs and around 200,000 indirect jobs and called for a "maritime growth agenda". He emphasised very clearly that the situation was very serious.

Dr Reinhard Lüken Managing Director of the VSM during the press conference

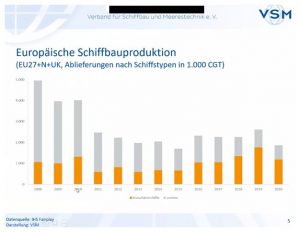

Dr Reinhard Lüken, Managing Director of the VSM, covered the entire market segment in his presentation and emphasised the huge influence that Chinese subsidy policies have on international and, in particular, European markets. The construction of cruise ships and large yachts has brought growth to the German shipbuilding industry in the last decade and has been recognised worldwide for its high performance. In addition to these two types of ship, supplemented by sophisticated government and naval vessels, other market segments are becoming increasingly difficult to serve. Even before the pandemic, orders in important sub-segments such as ro-ro ships and large ferries were predominantly going to Asia despite proven specialisation due to massive distortions of competition. Protectionist tendencies are also having an increasing impact in the supplier sector.

It is not just the shipyards that are affected, but the entire value chain: around 2,800 companies are active in Germany. The Chinese drive to expand not only affects shipyards, but also suppliers, shipping companies and harbours. German SMEs are suffering from this distortion of competition.

"We are all entrepreneurs and prefer to rely on our own strengths and our ability to prevail in fair competition. Unfortunately, government-imposed framework conditions play a central role in shipbuilding. As a German SME, you cannot compete against the strategic actions of the Chinese state. That is why we need an active policy. The current framework conditions threaten the irreversible loss of essential shipbuilding capabilities." Said Harald Fassmer.

"It is now about more than just bridging a lack of demand as a result of the coronavirus crisis. European shipbuilding has been losing market share for decades because predatory competition is being practised in Asia in particular with massive subsidies and Europe is doing nothing about it. This is why the question is now whether the civilian shipbuilding industry will still be able to exist to any significant extent in Germany and Europe in ten years' time." added Bernard Meyer, Managing Director of Meyer Werft GmbH & Co. KG.

"It is now about more than just bridging a lack of demand as a result of the coronavirus crisis. European shipbuilding has been losing market share for decades because predatory competition is being practised in Asia in particular with massive subsidies and Europe is doing nothing about it. This is why the question is now whether the civilian shipbuilding industry will still be able to exist to any significant extent in Germany and Europe in ten years' time." added Bernard Meyer, Managing Director of Meyer Werft GmbH & Co. KG.

"The world's most sophisticated ships and boats are built at German shipyards and equipped with German machinery and systems. German companies have excellent expertise along the entire value chain of the shipbuilding industry, which is urgently needed right now for the maritime transformation and climate protection. We must utilise the existing technological lead to achieve the climate targets quickly - through investment and financing instruments for the construction of a modern, effective, environmentally and climate-neutral fleet in and for the EU," emphasises Dr Uwe Lauber, Chairman of the Executive Board of MAN Energy Solutions.

The current situation in naval shipbuilding is much better at the moment. The German Navy has a lot of catching up to do and German naval shipbuilders also enjoy a good reputation worldwide. "In the medium term, however, we fear that the pandemic will also have an impact here, because the increasing national debt all over the world in the course of crisis management will limit the scope for public investment. This could affect the necessary procurement projects of the German Navy as well as the export demand that is important for us and ensures our capacity," explains Friedrich Lürssenshareholder of the Lürssen Group.

The current situation in naval shipbuilding is much better at the moment. The German Navy has a lot of catching up to do and German naval shipbuilders also enjoy a good reputation worldwide. "In the medium term, however, we fear that the pandemic will also have an impact here, because the increasing national debt all over the world in the course of crisis management will limit the scope for public investment. This could affect the necessary procurement projects of the German Navy as well as the export demand that is important for us and ensures our capacity," explains Friedrich Lürssenshareholder of the Lürssen Group.

VSM calls for maritime growth agenda

For all these reasons, in addition to short-term support measures, the VSM is particularly in favour of a fundamental examination of developments in the shipbuilding market. Extensive technological and industrial capabilities are still available to lead the shipbuilding industry in Germany into a successful future. If we do not find solutions, the damage will be irreversible.

"The European Union has the largest single maritime market in the world. The geography of our continent ensures an abundance and diversity of economic activities on and under the water. That is why we in Europe have it in our own hands to optimally utilise our entire range of maritime capabilities for growth and sustainability. But to do so, we need a fundamental restructuring of the framework conditions," said Dr Reinhard Lüken.

Questions were answered at the end of the event, but the digital world feels unsuitable for a desirable lively debate. We are therefore looking forward to a face-to-face meeting in 2022.

You can download the VSM annual report at http://www.vsm.de call.

Text: Schlüter / VSM

Photos: PK VSM

Despite all the understanding for the problems in Germany, in my opinion there is no clear security policy derivation on the question of why Europe, and subsequently Germany, needs a strong merchant fleet. Do Europe and the EU have a common maritime trade policy?

Where do European shipping companies actually have their ships built? Why are so many European merchant ships still flagged out?