The world's corvette and frigate fleets attract considerable operational and market interest. This emphasises the importance that will be attached to them in the future.

Corvettes and frigates remain at the centre of planning and investment for several reasons. Firstly, the two ship classes are among the most numerous types of multi-purpose surface combatants available. Unlike patrol vessels, combat boats, speedboats and other types of ships that have been specifically optimised for one mission, corvettes and frigates are generally designed to carry out missions in several maritime operational areas. In particular, this includes combating surface, air and FK attacks as well as submarine hunting. Secondly, corvettes and especially frigates are the largest and most powerful surface platforms in many navies worldwide and are therefore often referred to as "capital ships" in these nations. Finally, as units that can operate either individually or in formations of many ship types, corvettes and frigates offer fleet commanders a wide range of operational options. On board, the commanders and crews must face the challenge of mastering the many facets of seamanship like hardly any other ship type in the navy.

This article provides a brief overview of the international frigate and corvette programmes, drawing on forecasts and data from AMI International, a naval market consultancy that has been serving the industry worldwide for over 30 years. It begins with a look at the corvette and frigate newbuildings due to enter service over the next 20 years, as well as trends and regional developments for each type. It concludes with a brief look at the number of corvettes and frigates currently in service as well as details on regional designs, special features of the ship's construction and the average age of the types.

Corvette fleet declining

The corvette fills an interesting gap in the surface combatant market, as these ship types share features of both smaller fast attack and patrol craft (size and hull features) and larger frigates (weapons and sensors). Corvettes and offshore patrol vessels (OPVs) also share many design features.

AMI defines a corvette as a well-armed ship with a speed of at least 25 knots and a displacement of between 700 and 2000 tonnes. A corvette is generally not intended for longer ocean operations, but has a higher speed and therefore a lower endurance and range than an OPV.

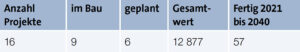

AMI forecasts that the corvette market will comprise 57 new hulls with a total procurement value of 12.9 billion dollars over the next 20 years. This makes the corvette one of the smaller sub-segments of the global naval market, accounting for around one per cent of the market for naval vessels in terms of value and around two per cent in terms of the number of units over the next 20 years.

The average value of corvettes earmarked for procurement is around 225 million dollars, with an average maximum displacement of just over 1500 tonnes. The countries procuring new corvettes are generally smaller or medium-sized navies, for whom the affordability of the corvette compared to the frigate is an attractive aspect of this type of ship. Of the 15 countries expected to add corvette newbuildings to their fleets by 2040, three countries, Ukraine, Turkmenistan and Azerbaijan, were part of the former Soviet Union, while two others, Poland and Bulgaria, operate in waters on the flanks of the former USSR.

Among the more significant navies with corvette programmes, Russia and Germany are the most strongly represented. Remarkably, AMI does not see any new corvette programmes in China's naval future, although, as described below, the People's Republic is expected to acquire 50 new frigates under two programmes over the next two decades.

Turkey stands out as a country that has had some success in corvette exports with its indigenous Milgem corvette design. AMI classifies the 3000-tonne Milgem G design modified for the indigenous armed forces as a frigate, but Milgem exports to Ukraine and Pakistan are based on the original Milgem corvette, which is around 1000 tonnes smaller.

In the past, corvettes were primarily intended for anti-submarine warfare and their use and design can be traced back to the convoy escort ships of the Second World War. In the post-Cold War era, however, corvettes have evolved into multi-purpose platforms. Today, they are often seen as "junior partners" to frigates in combined fleet operations, with the ability to conduct at least limited independent operations across the entire spectrum of anti-submarine, anti-surface and anti-air warfare (ASW, ASuW and AAW) missions. Of the 57 new corvettes in the AMI market forecast, almost all are equipped with anti-ship missiles and guns as well as cannon- or FK-based air defence capabilities. Corvettes generally have some anti-submarine warfare capability with sonars and ASW missiles or torpedoes.

The global inventory

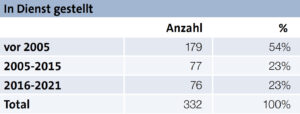

AMI records a total of 332 currently operational corvettes in its database. As only 57 new corvettes are to be built in the next 20 years, a decline in the number of corvettes by 2040 seems inevitable. This will increase the incentives for navies to invest in modernisation to keep their units in service and meet operational requirements, as they cannot be replaced one-for-one by ongoing or planned new build programmes.

The age distribution of these 332 corvettes in service is as follows:

More than half of the world's active corvettes are 15 years old or older, which is another sign that the corvette segment will shrink by 2040, when most of these older ships will have been decommissioned.

The big sisters

AMI defines the frigate as a medium sized surface combatant with a displacement of between 2000 and 5000 tonnes, either optimised for a specific role such as submarine hunting or air defence, or as a multi-role combatant with fewer systems and capabilities than a destroyer. A frigate is usually the smallest surface combatant capable of extended blue water operations under high threat.

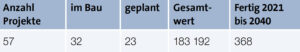

It is forecast that the frigate market will comprise 368 new units with a total value of 183.2 billion dollars over the next 20 years. Although the segment is 15 times larger than the corvette market, frigates only account for 15 per cent of the total market in terms of value. A similar figure emerges when looking at the absolute number of ships. In comparison, the market for submarines, with just 300 units, represents around a third of the total naval market of around 400 billion dollars over a period of 20 years.

Looking at future frigate procurements by region, the Asia-Pacific region leads the way with 15 countries accounting for 20 of 57 programmes (35 %) and 167 of 368 new units (45 %). This is followed by the NATO countries excluding the USA and non-NATO Europe (Finland and Sweden) with 11 countries and 15 programmes, which are expected to build 73 new frigates (20 %).

The AMI forecasts for future frigates to be procured globally are an average of USD 495 million per ship and a maximum displacement of just over 3800 tonnes. The regional averages for the Asia-Pacific region and the euro zone are shown in the table, with frigates in the Asia-Pacific region being slightly larger than in Europe at 4100 tonnes. In contrast, the average acquisition costs in Asia are said to be lower, averaging only around 400 million dollars per unit. This difference reflects the high proportion of Chinese ships in the Asia-Pacific region (50 of the 167 units). Although the actual acquisition costs for these are not known, they are generally significantly lower than for frigates built in Europe.

According to AMI, the fleet lists currently include 575 frigates worldwide. With an estimated average lifespan of 30 years, around 200 frigates are expected to be decommissioned by 2040. Given the 368 units currently under construction, this indicates that many nations are expanding their frigate fleets and building more ships of this type than need to be replaced. This trend is particularly true in the Asia-Pacific region, where China is expected to build 50 new frigates with an average displacement of 4,500 tonnes over the next two decades. Japan's frigate programme envisages 22 new Mogami-class ships for its self-defence forces over the same period, while the three different Indian frigate programmes are expected to produce a further 17 new ships of this type.

Conclusion

The corvette and frigate ship types appear to be heading in different directions on the naval market. The steadily increasing average age of corvettes in service and the relatively low number of newbuilds compared to decommissioning indicate that the importance of this ship type will decrease for many nations over the next two decades. In contrast, the number of orders for the construction of new frigates is robust. This can be seen both in navies that have long relied on this relatively versatile surface combatant in their fleets and in navies whose size and capabilities are increasing. China is the best example of such a "frigate growth market", but India, Indonesia and Malaysia can also be counted among them.

Bob Nugent