The VDMA (Verband Deutscher Maschinen- und Anlagenbau eV) Division Marine Equipment and Systems answered questions from the press at the Hafen-Klub Hamburg.

Dr Jörg MutschlerManaging Director Marine Equipment and Systems, had the Chairman of the Executive Board Martin Johannsmann (SKF Marine GmbH, Hamburg) and member of the Executive Board Dr Lars Greitsch (Mecklenburger Metallguss GmbH, Waren) and member of the Executive Board Hauke Schlegel invited.

The outlook for shipbuilding suppliers was good for the future, with turnover rising by 5.8 per cent to EUR 11.3 billion in 2023. With order intake stagnating in 2023, however, good capacity utilisation is expected due to investments in climate-neutral shipping. However, the complaint heard time and again is that EU bureaucracy is hampering production. "Last year's stagnating order intake will not stabilise, but was probably just a short "breather" after the very strong order intake in previous years. Shipowners are now not only continuing to invest in newbuildings, but above all in the modernisation and retrofitting of the existing fleet. The IMO requirement for climate neutrality is certainly a strong driver here, especially in the global service and spare parts business," said Martin Johannsmann, Chairman of the Executive Board of VDMA Marine Equipment and Systems and Managing Director of SKF Marine GmbH. "As an industry, we have developed the necessary technological solutions with foresight and in a timely manner, but we also sense that the enormous volume of necessary retrofits could not only reach capacity limits, but also monetary limits for operators," he added.

The outlook for shipbuilding suppliers was good for the future, with turnover rising by 5.8 per cent to EUR 11.3 billion in 2023. With order intake stagnating in 2023, however, good capacity utilisation is expected due to investments in climate-neutral shipping. However, the complaint heard time and again is that EU bureaucracy is hampering production. "Last year's stagnating order intake will not stabilise, but was probably just a short "breather" after the very strong order intake in previous years. Shipowners are now not only continuing to invest in newbuildings, but above all in the modernisation and retrofitting of the existing fleet. The IMO requirement for climate neutrality is certainly a strong driver here, especially in the global service and spare parts business," said Martin Johannsmann, Chairman of the Executive Board of VDMA Marine Equipment and Systems and Managing Director of SKF Marine GmbH. "As an industry, we have developed the necessary technological solutions with foresight and in a timely manner, but we also sense that the enormous volume of necessary retrofits could not only reach capacity limits, but also monetary limits for operators," he added.

Sustainability goals in shipping

Sustainability goals in shipping

The International Maritime Organisation (IMO) has set the strategic goal of achieving climate neutrality in shipping by 2050. Important interim targets for greenhouse gas reduction have been set for 2030 (minus 30-40 per cent) and 2040 (minus 70-80 per cent). "We wholeheartedly welcome these targets," says Martin Johannsmann. "All companies in our industry have recognised the issue of sustainability in the development of their products as an absolutely necessary step into the future and are implementing it. However, what is important above all is a stable political environment that sets the appropriate course promptly and reliably, for example to be able to produce enough alternative fuels for the global merchant fleet (on an industrial scale) in the foreseeable future". Maritime shipping is already the most environmentally friendly mode of transport. Due to the large volumes transported, it emits 2 to 3 per cent of global CO2 emissions. "As a shipbuilding supplier industry, we have a great responsibility in the development of environmentally friendly products. Often in cooperation with other companies, we develop and design efficient, interlinked systems that enable the most effective overall reduction in greenhouse gases," explains Dr Lars Greitsch, Member of the Board of VDMA Marine Equipment and Systems and Managing Director of Mecklenburger Metallguss GmbH. "Furthermore, it is important for us to produce in a climate-friendly way, especially at our own locations, but also in Europe. As a maritime supplier, we are pioneers in many areas and have achieved good results in climate-friendly production. However, what is difficult to implement in a medium-sized production company is the ever-increasing effort involved in processing the ever-new EU regulations, such as the Corporate Sustainability Reporting Directive (CSRD) or the German Supply Chain Sustainability Act (LkSG). The necessary processing and reporting require more and more personnel capacity. At the same time, employees must become more and more productive in order to survive in international competition," adds Greitsch.

Concern about offshore expansion

The VDMA is very concerned about the expansion of wind power. The ambitious goal of turning the North Sea into a huge power plant in the future cannot yet be achieved with certainty. Today, wind power is not even sufficient for the electricity market. The construction of converter platforms was also discussed. China is seen as a sales market, but also as a competitor. If you cannot create sufficient capacity yourself, will China take over the market - just as the Chinese destroyed the German solar market?

Recruitment of young talent

Recruitment of young talent

Employment in the shipbuilding and offshore supply industry rose to a good 64,500 highly qualified employees last year. Recruiting young talent is seen as the industry's issue for the future. "We can only continue our current growth with sufficient young talent. We can reach young people in particular if we can continue to show them the "meaningful added value" of their work with us," says Lars Greitsch, "this includes as much creative freedom as possible and as few bureaucratic, non-value-adding requirements as necessary. During the Q&A session, it became clear that the shortage of skilled labour is also a result of changing lifestyles.

Shipbuilding and offshore supply industry in figures:

64,500 employees (2023: 64,000 employees) generated a turnover (2023) of 11.3 billion euros (2022: 10.7 billion euros). The export ratio was 79 per cent.

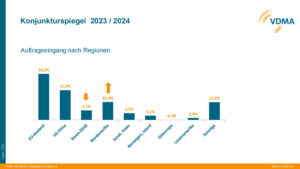

The German shipbuilding and offshore market directly purchases around 20 per cent of products. Other European countries confirmed their stable role as an important export market for German suppliers (35 per cent of exports). Overall, the industry supplies Germany and Europe with almost half of its products. North America has grown significantly as a market. China and Korea continue to play an important role as sales markets.